Today’s senior living marketplace offers ample housing opportunities for seniors in upper income brackets, as well as subsidized housing for low income seniors. However, these two groups comprise merely 30 percent of the nation’s senior population. What, then, about the remaining 70 percent?

Few housing choices exist for those in the middle, presenting a challenge – and an opportunity – for architects, developers, and financial institutions serving senior living. Aptly named, the middle market includes seniors who have too much in financial resources to qualify for government support programs such as Medicaid, but not enough to pay for most private pay senior living options for very long.

Whether by choice or financial circumstances, a growing number of seniors are not “retiring” in the traditional sense. Increasingly, they are interested in remaining engaged with the broader community and even working, perhaps in a less-than-full-time capacity. Living options that offer easy access to community destinations, flexible spaces, storage, and ample parking are already popular today. And, as baby boomers approach traditional retirement age, alternatives to the traditional senior living community will be in demand.

This perfect storm of factors has housing, finance, and development experts assessing whether to build more market-rate housing or create new brands to serve the middle market. The middle market creates a unique opportunity for senior living providers, developers, architects, and financial professionals to develop a new level of housing for today’s middle market that will be more likely to meet baby boomers where and how they want to live when it’s time.

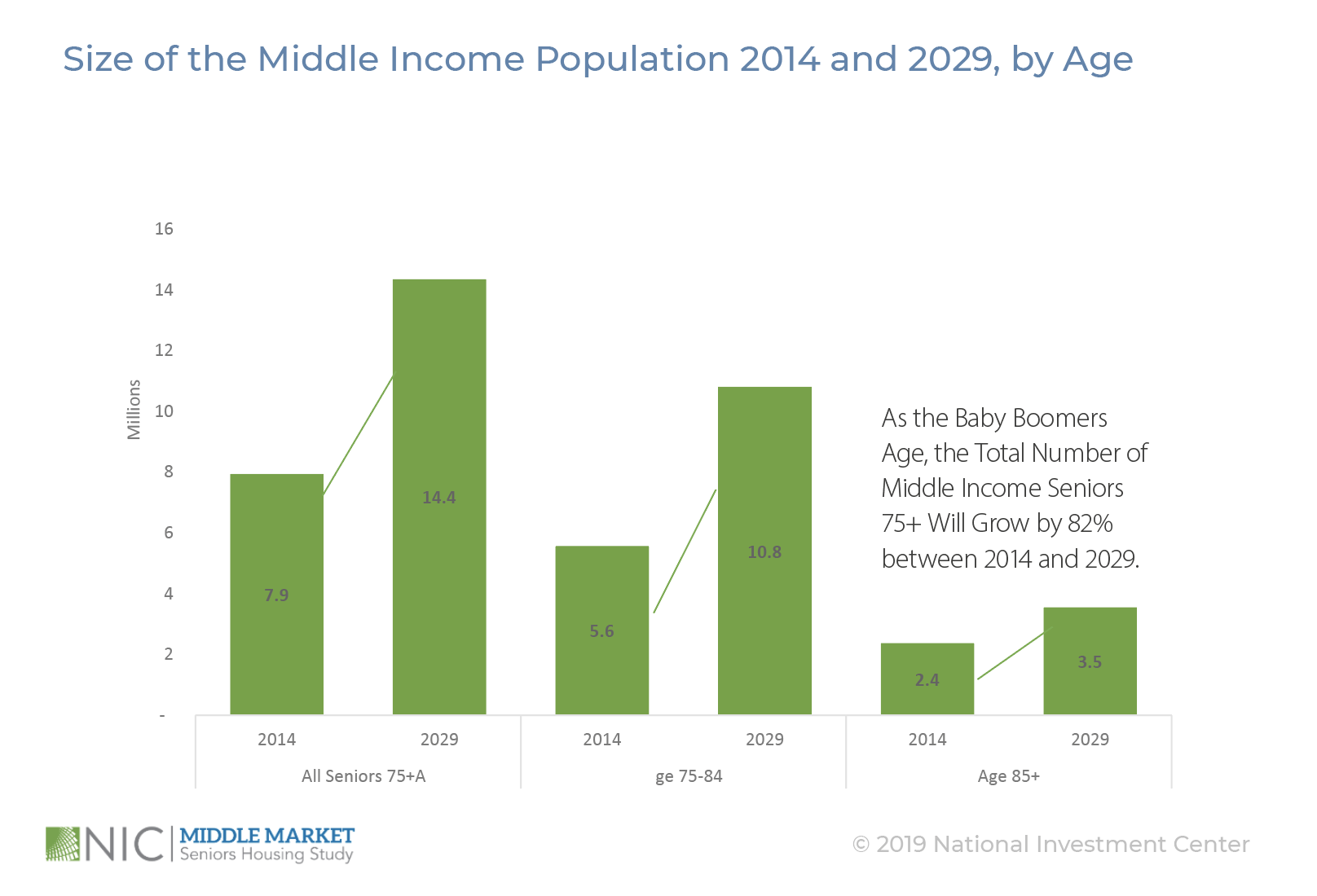

The imminent demand of the middle market is real. As seniors retire over the next decade, approximately half will not be able to afford private-pay senior housing at today’s market rates, according to NIC research. Architects, developers and financial institutions must act quickly to explore options and create solutions. Building partnerships with municipalities, government agencies, regulatory officials, insurers, and community service providers in healthcare, fitness, food and dining, and transportation can be key to bringing middle market housing communities to life.

Careful evaluation is needed to assess what is available—and what is missing—from communities that can provide the foundation of middle market housing. Is land available for new development, and are officials willing to negotiate zoning variances to spur progress? What existing building types exist to be repurposed and what nearby services or amenities are available? Above all, what funding opportunities are available to bring the project to fruition?

The cavernous gap between upper and low-income consumers presents both challenges and opportunities for senior living providers. Those who successfully rise to the challenge will benefit from tremendous market demand, while also moving the industry forward to better accommodate all of our nation’s seniors.

To learn more about how Lenhardt Rodgers helps clients address the middle market, request a free consult.